Journey to Financial Independence

My own journey to financial independence (FI) wasn’t exactly smooth and well executed. I was always a good saver and investor but I didn’t really consider the endpoint thoroughly until I got there. That’s not to say I didn’t have the end goal in mind, I did. But I didn’t have a clear picture of how my assets should be allocated at the time of FI so I had to scramble a little bit at the finish line to make sure my portfolio was set up to support retirement spending.

Part of the problem is that most of the available investment advice is geared towards the accumulation of assets. The accumulation mindset is great while you’re in the portfolio building years. But I think it’s useful to have a clear idea of where you want your portfolio to end up at the time you’re ready to stop taking a real paycheck from a job and start taking money out of your portfolio. This “decumulation” process is something I have a much better handle on now that I’ve reached the FI milestone and it informs how I now think about the whole financial journey in retrospect.

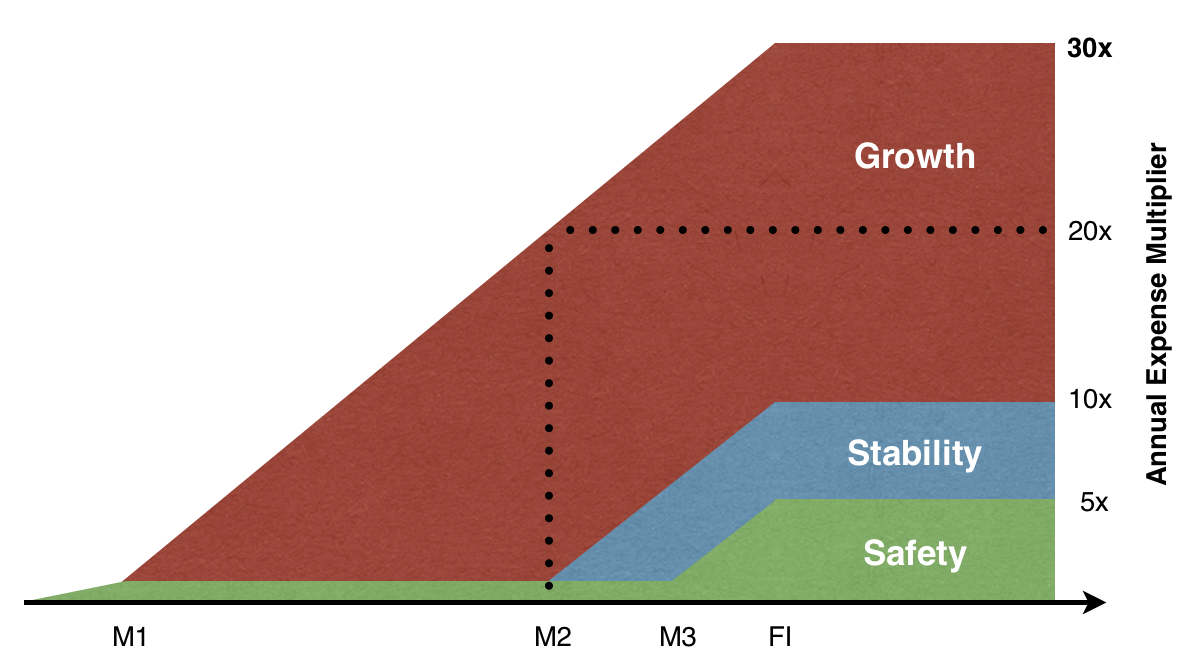

As such, in this article I propose what I think is a lifelong investment strategy that is better geared towards achieving and maintaining FI. The graph below illustrates this strategy using a hypothetical timeline from an investor’s beginning all the way through FI.

In order to keep the discussion simple, I have identified just 3 types of investment buckets: growth (red), stability (blue), and safety (green).

Generally speaking these buckets are what they sound like:

- Growth - assets that aren’t needed for at least 10 years. Growth assets have the advantage of time and this is the part of your portfolio that can take maximum risk. Invest in assets that can be volatile in the short term but give you higher returns in the long term such as stocks, real estate, long-term bonds.

- Stability - assets that may be needed in the medium term (5-10 years). Invest in assets which have a relatively low risk but still some possibility for gain to keep up with inflation such as medium-term bonds or long-term CDs.

- Safety - assets that might be needed in the near term (less than 5 years). Invest in assets that have very low risk of losing value such as savings, CDs or short-term bonds.

Understand Your Expenses

Before you do anything, you really need to have a handle on your current

monthly expenses. Knowing your expenses is a key to implementing this

strategy and allows you to easily monitor your progress.

Also, being aware of your expenses drives home the fact that lowering your

expenses is a key towards reaching your goals sooner.

It’s the one variable you have the most direct control over.

If you’re not sure of your expenses, sign up for one of those services that will help you track them. Understanding where your money goes and how much you spend every year is vital to informing where you are and how to invest your assets.

Milestone #1 (M1) - Emergency Fund Invested in “Safety”

The first milestone in any investor’s life should be to set up an emergency fund using “safety” investments. In my opinion, the primary purpose of the emergency fund is to handle employment gaps. So the size of your emergency fund should reflect how much time it might take you to find a new job if you find yourself temporarily unemployed. For example, if you work in a high demand field then maybe just having 3 months worth of expenses saved in your emergency fund is adequate. But if your skills are very specialized, you might want to consider something like a year’s worth of emergency funds. If you’re not sure, default to 6 months of expenses.

The emergency fund is the ballast of your “safety” bucket and should be invested for safety only. Resist the urge to invest these assets for growth. The purpose of this fund is as a safety net, so you don’t want to risk having it decline in value when you need it most. After you have fully-funded your emergency fund it’s time to switch gears and invest for long-term growth. The simplest “growth” investment is 100% stocks using something like a total market stock index fund. But if a 100% stock allocation seems too risky for you then consider a mix of stocks and bonds such as 90/10 stocks/bonds, or 80/20 stocks/bonds. But I wouldn’t go above 30% bonds in the “growth” bucket because you will be adding more bonds to the overall portfolio later when you start adding to the “stability” bucket.

Milestone #2 (M2) - 20 Years of Expenses Invested in “Growth”

You can certainly celebrate other milestones such as 1, 5 and 10-years of expenses in your “growth” bucket. But the 20-year milestone is a big deal! When you have 20 years of expenses saved in growth, then the light of retirement is visible at the end of your investment tunnel. After you hit this milestone you are beginning a transitional phase that sets you up for FI.

A Better Rule of Thumb for Bonds

Having hit 20x expenses in growth, it’s now time to start investing for “stability”. Ultimately the “stability” bucket is the part of your portfolio that helps to cover expenses that are a few years out, say 5-10 years. So instead of the rules of thumb for investing in bonds that are based on your age, I believe it should instead be based on how much you have invested in the “growth” bucket. I would state this new rule of thumb for bonds as follows:

Start investing in your “stability” bucket (bonds) after you have accumulated 20 times your annual expenses in your “growth” bucket.

There are 2 key points to this seemingly simple rule. First, it’s not based on age but rather on your progress towards your goal of financial independence. Second, this rule puts the focus on your expenses as the key to measuring how close you actually are to that FI goal.

After having hit the 20x milestone (M2), then once every year I suggest you sweep your “growth” gains into your “stability” bucket while keeping the “growth” bucket at 20x expenses. Conversely, if your “growth” bucket had a bad year, then rebalance some “stability” bucket funds back into the “growth” bucket to get it back up to 20x expenses.

This is a little different than traditional rebalancing concepts that are based purely on target percentages. Instead of a using target percentage, you are rebalancing based on a targeted expense multiplier (20x in “growth”). Think of it as filling in your ultimate FI allocation from the riskiest assets down to your least risky assets.

Milestone #3 (M3) - 5 Years of Expenses Invested in “Stability”

Once you have 5 years of expenses in “stability” and 20 years in “growth”, your overall portfolio will be at 80% “growth” and 20% “stability”. So you can see that your portfolio is becoming more conservative as you get closer to FI.

When you hit this milestone (M3), you’re not quite there yet but you can start to think seriously about your impending financial independence and whether you will want to continue working. As such, the next investment is back into “safety”. I’m suggesting that you save 5 years of expenses in “safety” but that number is somewhat arbitrary. The key is to have a comfortable amount of expenses in non-risky buckets so that you will be positioned to pull the trigger on retirement and not have to worry about a market correction in the first few years of retirement.

If you want, you can just add these “safety” funds into your existing emergency fund because the primary need for the emergency fund, to cover employment income gaps, is going away. In effect, your emergency fund is transforming from a safety net into a spending bucket.

Also, as with the previous milestone, you should still rebalance every year to keep your “growth” bucket at 20x expenses and you “stability” bucket at 5x expenses. Based on market conditions you may find you need to backfill either growth or stability. But you can also use gains from those buckets to feed into your “safety” buckets and get you to FI that much faster.

Milestone #4 (FI) - Financial Independence (30 Years of Expenses)

When you have 20x expenses in “growth”, 5x expenses in “stability”, and 5x expenses in “safety”, then congratulations! You have reached financial independence!

If you do choose to continue working after FI, I recommend putting all future extra savings into the long-term “growth” bucket because, by design, you won’t need those funds in the near term. Alternatively, you could also just keep the 20/5/5 growth/stability/safety ratios going and increase your spending accordingly when you do eventually retire.

If you had chosen to keep 100% stocks in your “growth” bucket then, when you hit the FI milestone, you will have 67% stocks in your overall portfolio. If you prefer to target a little smaller stock allocation in your portfolio at retirement, then you can use your target percentage to inform how much to keep in your “growth” bucket. For example, if you’d like to hit a target of 60% overall stocks on your FI date, then multiply the targeted stock allocation by 1.5 (30 years total / 20 years in “growth”) to arrive at a 90% stock percentage in your “growth” buckets. I think any stock allocation between 75-100% is fine for the “growth” bucket but you should give some serious thought to how you would feel if you reached FI right before the market takes a big hit. If you’re not sure, start with 90% stocks in “growth”.

Not Quite a Target-Date Fund

Astute readers may notice that this investment strategy has similarities to target-date funds. Generally those funds invest aggressively early on and become more conservative as you approach the target date. While I think target-date funds are pretty good for many people because of their simplicity, they differ slightly from the strategy in this article in a few distinct ways:

- First, target-date funds become too conservative if you hold them to maturity. Most target-date funds end up with a stock mix below 40% and some go as low as 24%. I think this is okay for a fund where you’re targeting a big purchase near that target date, but not necessarily for FI. You want your assets to keep up with inflation so I think your post-FI stock allocation should be somewhere in the 45-65% range.

- Second, target-date funds don’t give you a convenient way to access just the “safety” part of the portfolio such as the short-term bonds and money market funds. There is a peace-of-mind in being able to access risk-free funds for day-to-day expenses and ignoring the gyrations of the stock market.

- Third, target-date funds don’t adjust the goal date if your financial independence date changes because your portfolio is doing better or worse than expected. The strategy in this article would better be described as a “target expense” fund than a “target date” fund as it is personalized to your level of spending rather than an arbitrary future date.

So, if you use target-date funds during accumulation that’s fine. But consider that you will probably want to switch out of them at or near the time when you start the transition to retirement.

Other Considerations

While understanding your expenses is a key part of this strategy, it’s also important to consider any future pensions or social security payments you may receive. For example, if you expect to be receiving a $1000/month social security check at retirement, then you can effectively subtract that $1000/month from your expenses for the purposes of figuring out how much you need to reach FI. This could dramatically reduce the amount you need to invest/save to reach retirement.

Also, because it targets 30 years of expenses, this strategy effectively presumes a 3.33% withdrawal rate (1/30 = 3.33%). If you feel like your withdrawal rate should be different, you can modify this plan accordingly by changing the sizes of the different buckets slightly. But I think the plan as presented here is a good baseline for most people.

Finally, I didn’t give any details on the types of accounts used to invest these bucket assets. While that’s important I didn’t want to confuse the point of this article too much. Suffice it to say that it’s a good idea to have some tax diversity utilizing a combination of Roth, traditional and taxable accounts for your portfolio.

Key Takeaways

- This strategy is geared towards achieving your actual future spending goals

instead of aiming for an arbitrary retirement date.

This helps to clarify what you actually need while simultaneously giving you a good measure of your progress towards financial independence. - Put as much into the “growth” bucket as early as possible, then add

“stability” and “safety” later as you approach retirement.

This approach maximizes the amount of time your riskier assets have to grow. - Invest in “stability” (bonds) only after you have accumulated 20 years worth of expenses in “growth”.

- Multiply your desired stock allocation at retirement by 1.5 to arrive at the percentage of stocks to have in the “growth” bucket during accumulation.

- Following this investment strategy will slowly transition your assets into retirement so you don’t have to scramble to reallocate assets to an appropriate post-retirement mix.

- This strategy could be implemented with as few as just 2 or 3 funds. For example, you could put all of your “growth” assets into a total stock market fund, all of your “stability” assets into a total bond market fund, and all of your “safety” assets into a savings account or short-term bond fund. Also, after you reach FI you could combine your “growth” and “stability” buckets into a single balanced fund.

- Don’t forget to consider other sources of income in retirement such as Social Security or pensions. These other income sources effectively reduce the expenses you need to cover with your investment portfolio and can get you to FI faster.