To Roth or Not to Roth? - Part 1, The Ideal World

Most often when you see an article discussing whether to choose a Roth over a Traditional option (401k/403b/IRA), the decision is stated as a comparison between current and future tax rates. While that’s mostly correct advice, it fails to recognize that future withdrawals tend to occur across multiple tax brackets while current contributions tend to be in a single tax bracket. I first became aware of the concept of filling in lower tax brackets from an excellent piece written by The Finance Buff.

In this first of two articles, I take a look at an ideal-world example that explores the concept of how much should go towards a Roth versus a Traditional option. In the second article, I will take a look at some more real-world cases that should give more concrete advice on how to determine how much to contribute to each option.

Basics of Roth vs Traditional

First, let’s discuss the basic differences between the Roth and Traditional options. The most important difference between the two options is when you are taxed. Roth options are taxed now in that you fund them with after-tax dollars and you are not taxed again when you withdrawal the funds. Traditional options are taxed later, so you deduct your contributions from your taxes now and pay income taxes later when you make withdrawals.

If you want to maximize how much money you keep, the basic tradeoff becomes one of shifting the taxes to the point in time when you have the lower tax rate.

When the tax rates are equal now and in the future, then mathematically the amount you end up with is identical after the taxes are accounted for. However, in this case I recommend using the Roth option primarily because the Roth has fewer requirements on the distribution of funds.

The Tradeoff

When deciding how much money to allocate to a Roth, the basic goal is to allocate funds to the Roth that will be taxed at the same rate or higher in the future. Conversely, all funds that will fall into lower tax brackets in the future should be allocated to the Traditional option now. This last part is where most people fail to consider the whole picture. Just because you may be in the same or even higher tax brackets in the future does NOT mean that some of the funds won’t be taxed at a lower rate.

Filling Up The Tax Brackets

When you make a contribution to a Traditional IRA/401k/403b today, in most cases all of that contribution will be in your current income tax bracket. Sometimes you might also cross over to the next lower tax-bracket when making a contribution if you are near a tax boundary when you begin your contributions.

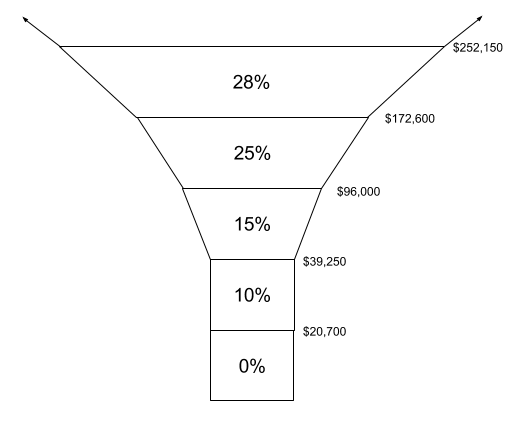

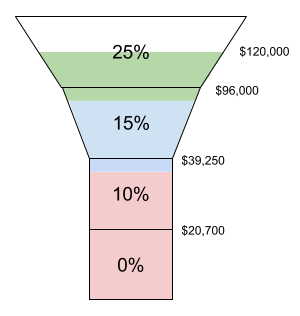

But in the future, when you start making withdrawals from your Traditional IRA, your withdrawals start filling in the tax brackets from the bottom up. I like to visualize this as pouring money into the income “funnel” as depicted below:

In 2016, for a married couple filing jointly, the personal exemption plus standard deduction is $20,700 so that amount is taxed at 0% (which I think of as the 0% tax bracket). Then the 10% bracket swallows up the next $18,550 of income, and the 15% bracket gets the next $56,750, and so on. I have made the tax brackets to appear as funnel-shaped because the brackets get bigger as income increases.

Of course, most people will have other sources of income filling in the lower tax brackets, and we will consider that case too. But the key point is that future withdrawals fill in tax brackets from the bottom up before reaching today’s marginal tax bracket.

So the goal of an investor should be to plan for today’s Traditional contributions to fill up tomorrow’s lower tax brackets, then invest the remainder in the Roth option. That sounds easy on the surface, but the hard part is figuring out how to translate that statement into actionable numbers.

Saving within a Single Tax Bracket

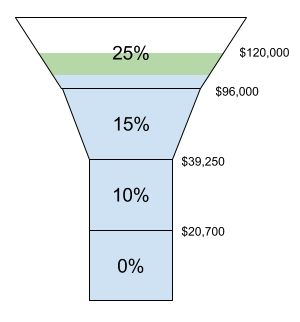

Let’s start by looking at a typical example where somebody has all of their savings occur within a single marginal tax bracket. Consider a married couple named Jon & Sally that makes a total income of $120,000 and saves a total of $16,000 to their retirement plans. If that money is saved in a Traditional retirement plan then they would have a gross income (AGI) of $104,000. With the standard deduction, the low-end of the 25% tax bracket occurs at $96,000 of gross income so the $104,000 puts them $8,000 above the lower threshold of the 25% tax bracket.

Let’s further assume that they are saving all they can afford to and that the $104,000 of income represents their current AND future day-to-day expenses. This is a bit of a stretch, but I would argue that most people’s spending habits don’t change all that much when they transition into retirement. You will probably be spending more in some areas in less in others but basically your spending profile won’t change by a drastic amount in retirement. Mostly I’m just trying to get a baseline equation, so stick with me for now. If that $104,000 of income represents what they need in the future (albeit in today’s dollars), that suggests that in the future their “livable income” would be roughly $8000 into the 25% tax bracket. In the extreme case where this couple has no other sources of retirement income, that would mean they would need about 96k/104k (92%) of their withdrawals to occur in tax brackets below 25% and the remaining 8k/104k (8%) would come out in the 25% tax bracket.

If you knew that your future funds would come out in the same tax bracket, then those funds might as well go into a Roth account today. So in this example, the couple could contribute 8% to their Roth. Mathematically,

percent_to_roth = (livable_income - tax_threshold) / livable_income

Assigning variables,

L = livable_income = current_income - max_savings

T = tax_threshold

then,

percent_to_roth = (L - T) / L

Other Income sources

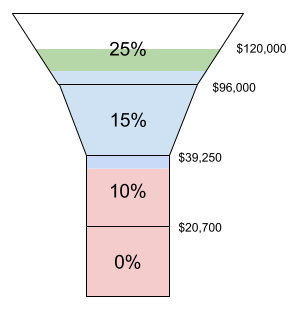

The one assumption that is hard to ignore is that the couple has no other income sources in retirement. But almost everybody has at least one other source of income such as Social Security or pensions, and many people will have multiple sources of income. So let’s adjust the math to account for that.

If Jon & Sally expect to receive other income in the form of social security that will total $36,000/year in today’s dollars, then their savings don’t have to provide the full $104,000 of income. Their savings only have to fill the funnel up between $36,000 and $104,000, which is a difference of $68,000. So when they convert their nest egg to future income, 8k/68k or about 12% of that future income is in the same tax bracket they are saving in today. That suggests that they could save 12% today in a Roth because it would likely be in the same tax bracket if deferred to the future.

Modifying the first equation,

percent_to_roth = (L - T) / (L - B)

where,

B = base income from "other" sources (in today's dollars)

Knowing what your future base income from “other” sources can be a difficult thing to figure out. But if you’re only expecting Social Security, I suggest you start off with about 40% of your current income. This is a very rough estimate based on the idea that, on average, people receive around 40% of their income back in social security. But you really should take a look at your actual social security (or equivalent) statements to get an idea of how much you’ll really get.

At what point does 100% of your total savings go towards a Roth? Mathematically,

if (L-T) > (L-B) the equation goes above 100%. This simplifies to the

comparison of B > T. So you should contribute everything to Roth when your

“base income” sources equal or exceed

your current lower tax threshold. That makes sense because it means that

if you know that you will be at or above the current tax rate in the future

you might as well contribute everything to Roth today.

Let’s just modify the equation slightly to account for this scenario,

percent_to_roth = min((L - T) / (L - B), 100%)

Saving Across Multiple Tax Brackets

Now let’s consider the case where Jon & Sally, are able to save enough to cross over into a lower tax bracket if the entire savings were deductible. So consider with the same $120,000 of income and a savings rate of $30,000 per year. This suggests that they are able to live comfortably off of the remaining $90,000 of income.

With the bottom of the 25% tax bracket is at $96,000, Jon & Sally would then be descending into the 15% marginal tax bracket. Since we’re assuming that the $90,000 of income represents their future income needs and $90,000 of income would be marginally taxed at 15%, everything they save in the 25% tax bracket should simply go to the Traditional savings option. Then they would apply the equation from earlier but only to the portion in the 15% tax bracket.

So the first $24,000 of savings goes into Traditional. The remaining $6000 of

savings would follow the previous equation, (90000-39250)/(90000-36000) or

94% of $6000, that goes to Roth. Notice that I’m using $39,250 as the low end

of the tax bracket because that’s where the 15% tax bracket bottoms out (for a

married couple using standard deductions). Finishing the

math for this example, 94% of $6000 is 0.94*6000/30000 or about 19% of the

overall savings that goes to Roth.

Mathematically, we can express the overall equation for the dual-tax bracket case like this:

percent_to_roth = everything in lowest tax bracket * previous equation

= min((T1-L) / S, 100%) * min((L - T0) / (L - B), 100%)

where,

S = total amount saved

L = livable_income

T0 = tax bracket threshold below L

T1 = tax bracket threshold above L

B = future base income

Here’s a plot of what Roth percentage looks like versus income levels for a married couple1 in 2016 with a savings rate of 12% and a future base income equal to 40% of their current income (move sliders below the graph to change percentages).

Savings Rate as Percentage of Income ():

Base Income as Percentage of Income ():

Insights

Looking at the plot of Roth percent versus income and playing with the sliders gives a few of insights.

- The Roth savings rate drops off rapidly right above each tax bracket. This is due to the fact that your savings at those income levels can quickly push you into a lower tax bracket. So if you save enough to cross over into a lower tax bracket, all of the savings in the higher tax brackets would tend to go towards the Traditional option, while most of the savings that cross-over into lower tax brackets would go towards the Roth option.

- The Roth savings rates tend to peak just below the tax bracket boundaries. That’s because you are as far away as you can be from the lower edge of the tax bracket which means that a higher percentage of your retirement income is likely to be in the same tax bracket (or higher) as you are in now.

- Increases to future income pushes the entire curve up. This means that the more you expect to earn from other sources such as social security and pensions, the closer your retirement tax bracket will be to your current tax bracket so you would tend to want to save more to a Roth.

When You Assume, You Make Me Read Part 2

While this analysis is interesting and moving the sliders around is fun, there are many assumptions that make it not particularly useful. Here are some of the more egregious assumptions:

- The model assumes that the investor will retire exactly when they have enough to retire without considering the probability that most people will either have too little or too much at the time of retirement. Assuming you work a little past the point of being financially independent, then you would probably want to allocate a little more to the Roth option because the extra savings in the Traditional option would fill up the lower tax brackets in the future.

- Returns on the invested funds and inflation were both ignored. If your investments beat inflation then the amount you have at retirement to fill in lower tax brackets would be larger. This also suggests allocating more funds to Roths.

- Employer matches were completely ignored. Since those matching funds would normally be in before-tax dollars, this would tend to suggest higher allocations towards the Roth option than shown in this analysis.

In Part 2 I’m going to change the perspective of the analysis from mostly theoretical to be a bit more practical. Also, instead of focusing how much to put in a Roth, I will change the perspective slightly to examine how much total money you should save in your Traditional savings option.

-

For the plot, I capped the qualified contribution at $48,000 because each person in a couple over 50 can contribute a max of $24,000 to qualified accounts. ↩