To Roth or Not to Roth? - Part 2, Reframing the Question

Many articles are written about the virtues of the Roth account1 or the Traditional account types, but it’s rare to find an article suggesting why you should probably consider having both types.

In this article I try to show that both types have their place, but the important thing is to understand the main concept that will help you to determine how much of each type you should have. In short, the thesis of this article is that you should first determine the maximum amount to contribute to your Traditional account, then you should allocate the remainder of your qualified savings to your Roth account.

Basics - Tax Efficiency

The core decision of choosing Roth vs Traditional comes down to your tax rate now (when you save the funds) versus your tax rate in the future (when you withdraw the funds). If your tax rates are identical now and in the future you should choose the Roth because it has more flexibility (access to principal, no distribution requirements). But if your tax rates in the future, at the time of withdrawal, are lower than your current marginal tax rate, then you could save money by deferring those taxes into the future.

If you’re a good saver, then there’s a pretty good chance that you should be using both Roth and Traditional. Why? Because there’s a very real possibility that your Traditional savings will outgrow the lower tax brackets, especially when you consider other future income sources.

Filling Future Tax Brackets

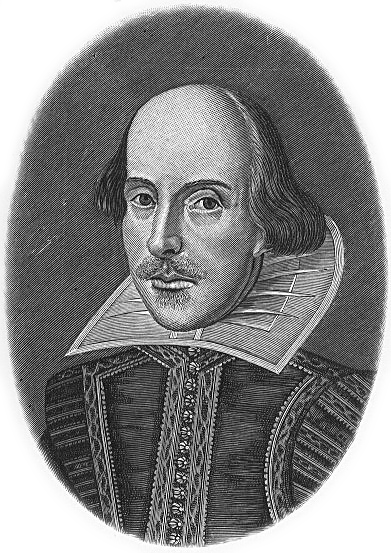

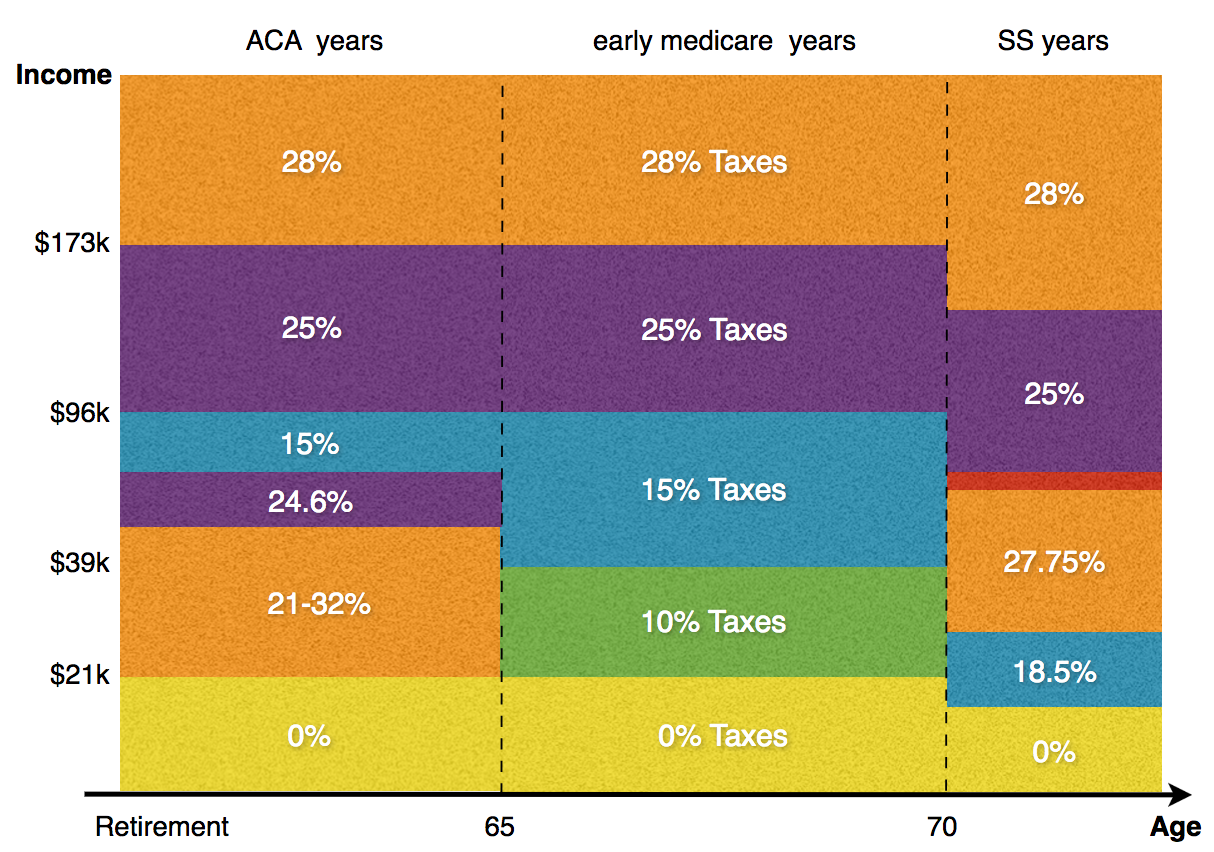

Think about your tax brackets over time. For example, in an over-simplified view of the world (ignoring inflation and other adjustments), your tax brackets might look like this.

Granted this is a naive view of tax brackets (they actually do change over time), but I’m just trying to make a point so ignore those details for the moment.

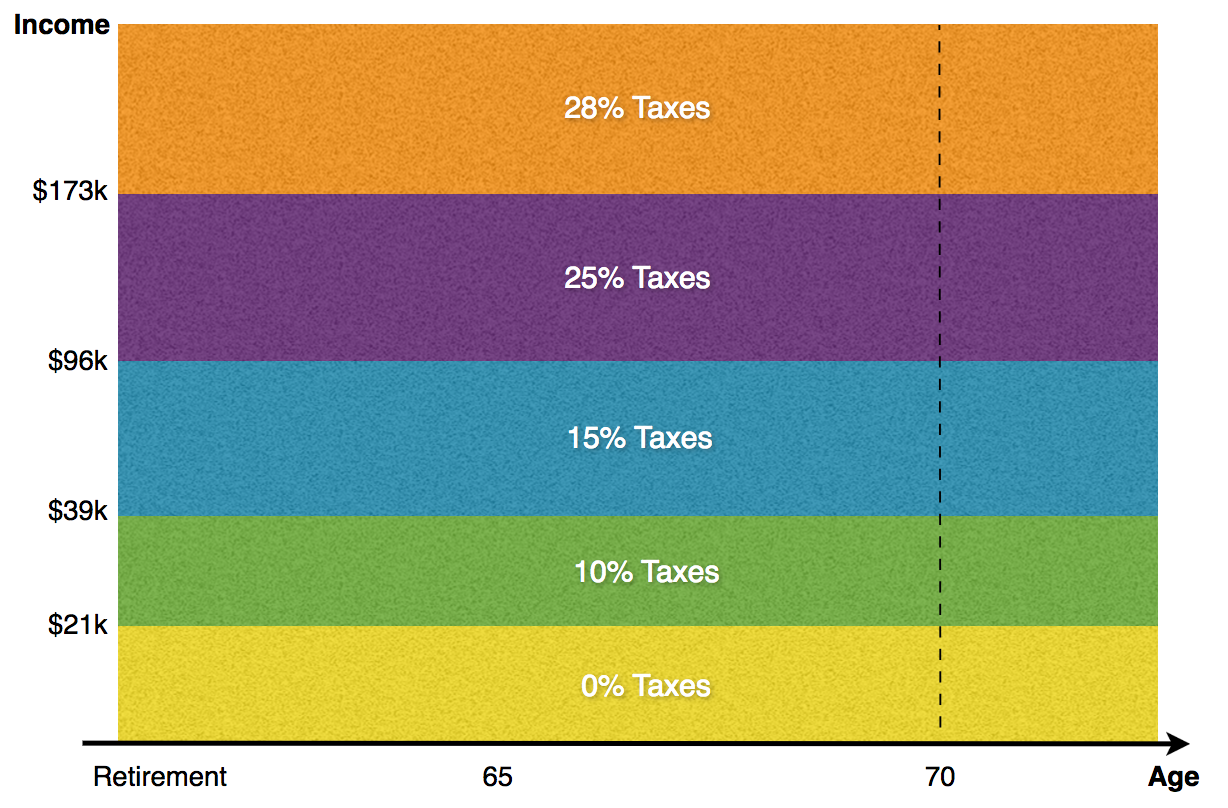

The general idea of saving to a Traditional account is that in the future you will take those withdrawals out in lower tax brackets. I like to visualize this as pouring those Traditional IRA funds into the lower tax brackets over the time that spans all of your retirement years. For example, the following picture shows IRA funds filling up the 0% tax bracket from retirement forward, which would be appropriate for anybody in a tax bracket above 0% (probably everybody reading this).

The idea of the above picture can be extended to higher tax brackets. For example, if you’re in the 33% tax bracket now, any savings you put into a Traditional IRA now could save you money in the future if they were poured into any tax bracket below 33% over the course of your retirement.

You might be thinking that the growth on the assets matter, but for this decision it really doesn’t. That’s because taking a percentage out now and letting your investment grow (Roth) is mathematically equivalent to letting your entire investment grow and taking the same percentage out later (Traditional). So it just comes down to figuring out when the tax rates will be lower.

The trick then is to figure out how big your Traditional account savings bucket can get before it starts to leak into your current tax bracket in the future. Because if you’re going to fill in your future tax brackets at your current (or higher) rates, then you might as well contribute to a Roth.

Upper Bounds for Traditional Accounts

So instead of determining what percentage to put in a Roth, the problem becomes one of figuring out the maximum absolute amount to put into a Traditional account.

We can approach this problem by putting an upper bound on the size of the Traditional IRA bucket (in the picture). Once you know what that upper bound is, you can project the maximum that your Traditional contributions should be in order to fill that bucket by your retirement date. The projection will never be an exact number because returns are unpredictable and retirement dates change. But if you have this framework in place, then you can make minor adjustments every year to account for the shifts in your portfolio balance and retirement date.

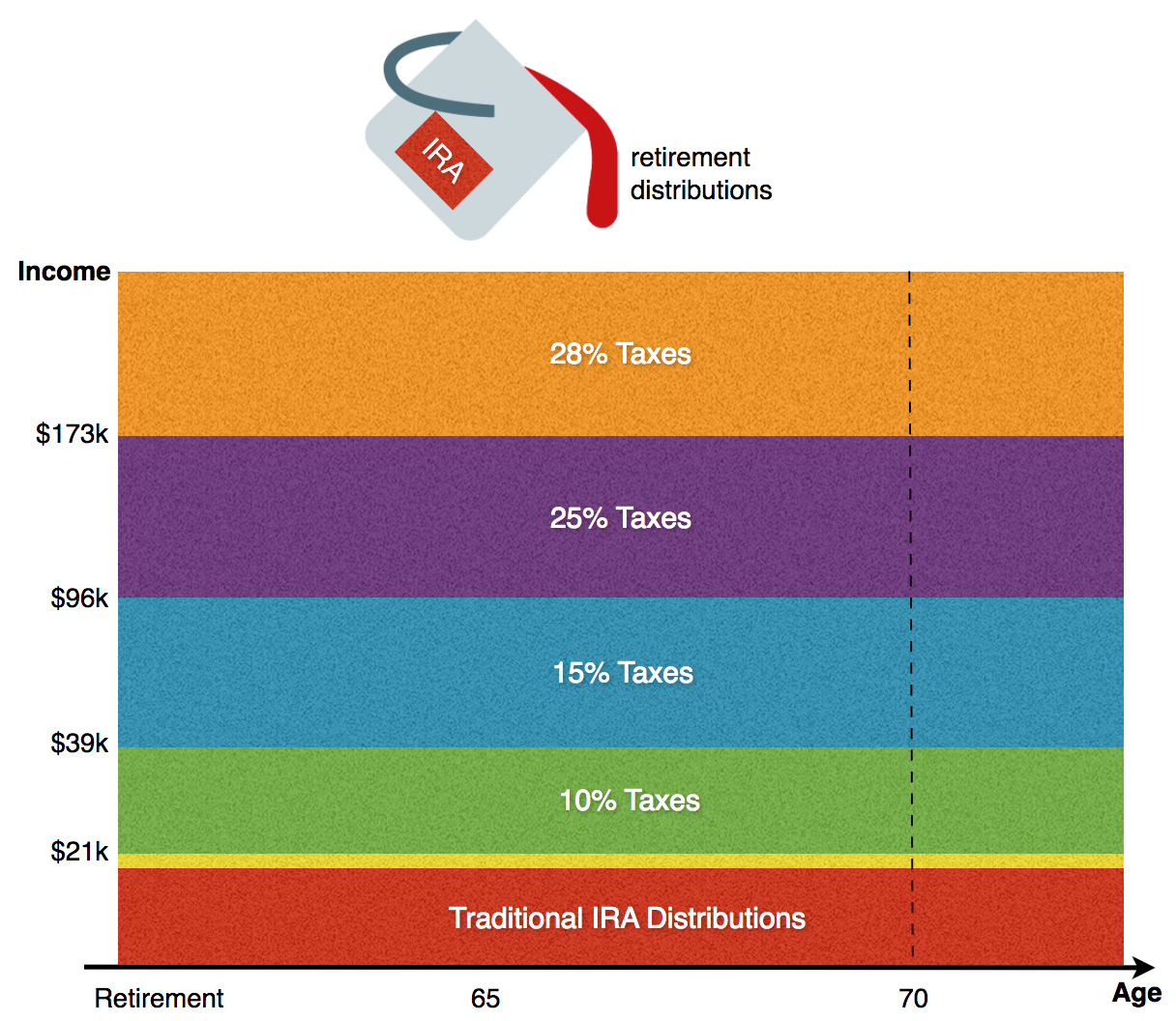

Other Income Sources

Probably one of the hardest variables to predict ahead of time is the amount of money you might get from other income sources. Social Security is one source that is fairly predictable, but what about income interest, dividends, side-job income, pensions, inherited IRAs, annuities, et cetera. You may have a good handle on what those sources are now, but it’s not always easy to predict all future income sources.

The effect of future income sources is that they fill in your lower tax brackets before withdrawals from your Traditional accounts. This means that you might have less room to withdraw funds in those lower tax brackets in the future. So the more future income you have from other sources, the less you should contribute to Traditional accounts now.

Realistic Tax Brackets

To determine the maximum Traditional contributions, we also should consider a more realistic view of tax brackets in retirement. If you’ve read previous articles on this blog you may be familiar with the effects of taxes of a couple life situations. There are 3 general bands that can effect tax brackets as show below. The picture below does not represent every situation but is meant to suggest how complicated it can get (your situation will be different).

If you are getting health care from the ACA before age 65 then you would fall into the band I’m calling the “ACA years”. Those people eligible to receive Affordable Care Act premium credits may see their tax brackets jumbled up by those credits before they start taking medicare at age 65. And this situation could very well change by the time you read this given the current political climate.

The second band, which I call the “early medicare years”, is the time before age 70 and after age 65. This band has a fairly “normal” tax bracket signature because it is not affected by ACA or Social Security effects on taxes.

Taking social security can effect the tax brackets at the lower end of the income spectrum. As discussed in a previous article on this blog these effects can have significant impacts to tax brackets at or below 25%. Also, since most people should probably delay taking social security until age 70 (your situation may vary), we will consider the case of retiring at age 70 while taking social security in the next article in this series in this band which I call the “Social Security years”.

Coming Next

The next articles in this series will attempt to address the different bands of time and how they might inform how much to save in Traditional accounts. Ultimately the goal is to give you the tools (and maybe a calculator) to estimate how much to contribute to Traditional accounts every year going forward until you exit the rat race.

Related

- To Roth or Not to Roth? - Part 1, The Ideal World

- Affordable Care Act May Increase Your Marginal Tax Rate

- How Social Security Messes With Your Tax Brackets

-

I use the generic terms “Roth” and “Traditional” to refer to all qualified accounts such as IRA, 401k and 403b. The basic concepts are the same regardless of the actual account vehicle you use. ↩